Indebtedness among the Marine Fishery Communities in Odisha

| Introduction | The Sample |

| Objectives of the Study | Empirical Findings |

| Methodology of the Study | Conclusion |

Fishery is a traditional occupation, which provides employment to a large number of people in the rural areas of the coastal districts of Odisha. In the past, marine fishing was a community-based activity where participants contributed to the effort mostly in kind. But with the introduction of sophisticated mechanical devices, the fishing sector became market oriented and monetized, where more cash was required to carry on activities Those who could not afford to invest in those devices earned less. Hence they required more credit to invest in efficient fishing systems and thereby improve their socio-economic condition. Since fishing operations are seasonal in nature and subject to vagaries of nature, fishermen require money round the year to make their both ends meet. With a low income base, high operational cost and lumpy investment requirements, the fishermen need more credit, (Narayanakumar and Sathiadhas 2006; Panikkar, 1998; Sathiadha et.al., 1994).

Traditionally, fishers borrowed from the informal sector creditors like moneylenders, traders, commission agents, friends and relatives (ICM, 2004). But these creditors used to charge exorbitant interest rate and exploit the borrowers in various ways. The traders and commission agents advance interest free loans to fishworkers in return for sale of their catches. But in return the loanee-fisher is obliged to sell his catches to the trader-lender, often at less than the market price.

To protect rural folks including fishermen from the clutches of the greedy informal sector creditors, a number of financial institutions with a multi-agency approach created for rural credit during the 1970s. It aimed at providing a variety of options to the rural folk for credit, thereby ensuring efficiency in credit delivery through built-in competition among financial institutions.

Banks have introduced many credit programmes for the benefit of the poor. These programmes, conceived at the macro-level have failed to meet the needs of the people at micro-level. The fishermen community has its unique features and the credit requirements are specific to the system. When natural calamities strike, they affect the resource base of the fisher folks and their credit requirements increase. A fisherman runs the risk of losing assets like nets, boats etc. in the deep sea. In such a situation, they need another loan to continue with the occupation. But banks do not sanction additional loans unless the earlier loan has been repaid. Besides, they need credit for consumption purposes, to tide over the temporary crisis, but the banks do not give loan for consumption purposes.

The state has a three tier Cooperative structure operating at the village (Primary Fisheries Cooperative Societies, PFCS), district and state level (Orissa Sate Fishermen’s’ Cooperatives Federation, FISHFED). Out of 986 PFCS, 225 are in the marine sector. Cooperative societies are supposed to provide credit facilities to fishworkers But their record in this regard has been somewhat patchy. The state government has supported the cooperative sector through contribution of share capital. The government does provide, periodically, assistance in the form of subsidies (UNDP, 2010).

Though micro credit has become an integral part of India’s financial system and it has the potential of bringing inclusive growth (Jayaraman, 2002; Nagayya, 2000), it has not played a major role in meeting the needs of the fishworkers. Moreover MFIs (MicroFinance Institutions) charge high rate of interest and are sometimes found to be exploitative.

SHGs (Self Help Groups) of fisherwomen are meant to facilitate group lending. The SHGs are small groups with less than 20 members. These groups are homogenous and informal. SHGs are generally NGO driven, and are promoted and nurtured by them, but sometimes they lack the incentive to serve widely dispersed small and inaccessible fisher villages along the coast line. In certain cases it has been observed SHGs are patronised and controlled by the local elites (FCRI, 2005).

A cursory look at the existing literature on the fishery sector reveals that the fishers have not been able to wriggle themselves out of the clutches of informal sector creditors. Keeping in view the importance of the study and the identified research gaps from the earlier studies, the present study has the general objective to assess the indebtedness of the fishing communities of Odisha. The specific objectives of the study are:

-

Developing an understanding of the nature, modalities, extent and implications of the informal credit provided by moneylenders / private traders and their agents both local and outsider to the marine fish workers in Odisha.

-

Identification of barriers to institutional credits for which fish workers are pushed to perpetual debt trap.

-

Examining the available options under the social and legal framework to formulate a systematic strategy (for addressing the indebtedness issue) in partnership with local and national government and stakeholders concerned.

The study is based on primary data collected from the stakeholders in the fishery sector. The fish-workers are not a homogeneous group- a number of critical factors like community, region, place of origin etc. distinguish one group from another. Each community has its unique features and socio-economic system. While selecting the sample, care was taken to adequately represent different groups among the stakeholders.

Information was elicited by canvassing questionnaires/schedules, and organising Focused Group Discussions (FGDs). The FGDs focused on revalidation of primary data collected. Two sets of questionnaires were used - one for the fish-workers and the other for the moneylenders/traders. Meetings were held with elites, SHGs, local level government officials and bankers to know their perception about the need and source of credit and related problems.

The study was conducted in the four districts where Samudram Project supported by Oxfam was in operation. Six Panchayats were sampled in each district for in-depth study. The Panchayats under Samudram projects were listed and arranged on the basis of their distance from the nearest market place.

While selecting fish workers for canvassing questionnaires, stratified random sampling technique was followed. The listed fishworkers were grouped into (i) fibre boat owners (2) country boat owners (3) fish workers without boat. In the next stage, 10 from the 3 groups were sampled in proportion to their number in the strata, that is, Panchayats.

Three focused group discussions, one each among male, female and a mixed group of respondents were held in each district. Interface discussions were made with moneylenders, traders and bankers to have an overall view of the credit market.

Officials of the government in the fishery department were contacted to elicit information about official programmes designed to promote fishery in the state and provide credit to fish workers.

4.1 Sample Area

The sample districts, namely, Ganjam, Puri, Jagatsinghpur and Balasore along the coastline of Orissa lie between 840 9’ to 870 29’ E longitude, and between 190 0’ to 210 59’ N latitude. All the four districts are bounded by the Bay of Bengal in the east.

Agriculture is the predominant occupation of the people and paddy is the principal crop. Besides, the farmers are found, in the recent years, to be increasingly cultivating the cash crops like groundnut, sugarcane, potato etc. Annual marine fish catch in a district is about 32,000 M.T. Among the sample districts, marine fishermen population is the highest in Balasore district (1,88,619), followed by Jagatsinghpur (65,987), Puri (45,575) and Ganjam (37,467).

4.2: Profile of Sample fish-workers

In area specific empirical studies, knowledge of the sample respondents is useful to draw generalisations. Some findings may be unique to the sample households and need to be adjusted to draw inferences in a different environment. Some basic information about the sample fisherfolk is given below.

The sample fish-workers are mostly Hindus. SCs constitute about 65% of the sample and about half that percentage (31%) are OBCs. There were only seven general caste and one ST fish-worker households in a sample of 240.

Nearly two-thirds of the sample fish-workers (65%) are in the age group of 30-50 years and relatively older ones (50 years and above) constitute 21%. The young (less than 30 years old) constitute only 14%. Most of the sample households (71%) have families with 3-5 members. More than half (55%) of the sample families are illiterate and about one-fourth (27%) have read up to primary level. Relatively higher educated with high school and above education constitute only 18%.

Fish catching is the primary occupation of most (93%) of sample fish-workers. About 4% reported fish processing and selling as their primary occupation.The remaining sample fisher families had non-fishery activities like daily wage labour, business, agriculture etc. as their primary occupation.

Since fishing is a seasonal activity, fish-workers take up secondary occupation to supplement their meagre income. Fish-workers take up business and other activities to keep themselves engaged during the off-seasons. In the sample, there were about 27 % of the fish-workers who worked as daily wage labour. And about 3% had taken up fishing related activities including fish processing/selling as their supplementary occupation.

One-third (34%) of the sample households annually earn Rs. 40,000/- – Rs. 50,000/- and another one-third (34%) earn more then Rs. 50,000/-. Average annual family income of one-fourth (24%) of the sample households is in the range of Rs. 30,000/- to Rs. 40,000/-. Only 8% of them reported to earn less than Rs. 30,000/- annually. About one-fourth of the respondents reported to have earned less than 50 percent of their total income from fishery.

The only valuable assets of marine fishworkers are nets and boats. Very few of the fish-workers in the sample districts own motorized boats. Most of them have non-motorised boats costing around Rs. 50,000. Two-thirds of the sample households (65%) own assets worth Rs. 50,000 –Rs. 2,00,000. Asset value of one-fourth of the respondents (25%) is more than Rs. 2,00,000.

5.1. Sources of Credit

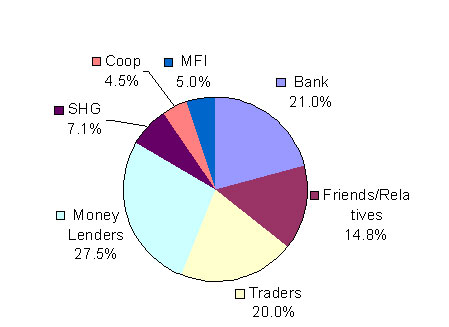

Banks accounted for only 21% of total credit of the sample fish workers (Chart 1) and the informal sector creditors provided the remaining 79%. Among the informal sector creditors, moneylenders were the dominant credit provider accounting for 27.5% of credit. They were followed by traders (20% of credit), who financed to the extent of 20%. Informal financial Institutions (IFIs) like SHGs, MFIs and co-operatives financed only 17% and friends and relatives provided 15% of total credit.

Bank finance to fish workers varied across districts. They accounted for 33% of sample fish-workers’ credit in Ganjam district, but only 6.6% in Puri and 9.9% in Balasore districts.

Informal sector dominates credit financing to fish-workers in all the districts. Their share (67%) is the least in Ganjam district and the most (93.4%) in Puri district. Moneylenders are the largest financiers in Ganjam (27.5%), Jagatsinghpur (34.9%) and Balasore (37%) districts. This credit goes to traders (32.6%) in Puri district.

Chart 1: Sources of Fishworkers’ Credit (Amount)

Informal financial institutions’ (IFIs) share in fishery sector credit was not insubstantial (16.7%). Though these institutions taken together accounted for about one-fourth of sample credit in Puri and Jagatsinghpur districts, they played a very minimal role in Ganjam district with 10% of sample credit; but their contribution in Balasore district was a little more, 17.1%.

When the number of loans are considered, bank loans are proportionately less (15.3%) (chart-2) compared to their share in the volume of loan (21%). Large number of small size loans from IFIs. Other informal sector creditors like moneylenders / traders and friends & relatives have given large loans to proportionately small number of borrowers.

Chart 2: Sources of Fishworkers' Credit (Number of Loans)

5.2 Loan Size

Fishworkers borrow for different purposes, ranging from subsistence to purchase / repair of boats/nets and credit requirement for different purposes. Fishworkers mostly borrow for boats / nets, where investment is large, about Rs. 1 lakh or more. An estimate of average loan size would show to what extent credit needs of the fishworkers have been sastified under the present arrangement.

Average loan size of the sample fisherworkers’ is Rs. 24,120/-, which is less than what is usually required by the fishers. On an average, bank loans are larger (Rs.33,069) than non-bank loans (Rs.22,497) IFIs usually give small loans (Rs. 11,509) on an average. The average loan size of the traditional informal sector, creditors like moneylenders, traders and friends & relatives are almost in the range of bank loans.

There is variation in the average borrowing of fishworkers across districts. Averages loan size is the maximum (Rs. 33,730/-) in Ganjam district and minimum (Rs. 18,418/-) in Puri district. Average loan sizes in Jagatsinghpur and Balasore districts are in the same range in Puri district (respectively Rs. 21,142 and Rs. 21,091).

Average Bank loan is as high as Rs. 51,542/- in Ganjam district, but very small, Rs. 10,210/- in Balasore district. Loans from banks for mechanised boats explains large sized bank loan in Ganjam district, since mechanisation of boats is less in Puri and Jagatsinghpur districts, bank loans are relatively smaller in size. Fishing in the open sea is mostly done with traditional boats in Balasore district. Average nonbank sector loans range between Rs. 17,925/- in Puri district and Rs. 28,816/- in Ganjam district. Non-bank loan size is larger where IFIs have failed to make a dent.

Chart 3 : Average Size of Fishworkers’ Loan by Source

5.3 Credit Intensity

Fishworkers borrow for different purposes, which can not be met from one source. A fishworker at times borrows from 2-3 sources. Their credit indulgence is reflected by credit intensity, measured by dividing the total number of loans by the number of borrowers. On an average, a sample fish-worker has 1.71 loans. Credit intensity of fishworkers of Ganjam district is the highest (1.75) and the least (1.25) in Balasore district; the corresponding figures in Jagatsinghpur (1.57) and Puri (1.43) lie in between. In a nutshell, a fishworker & generally have more than one loan.

Chart 4: Districtwise Credit intensity of fishworkers

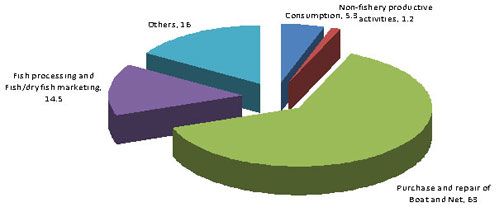

5.4 Purpose of Borrowing

Fishworkers borrow not only for fishing & fishery activities, but also for other protective activities and consumption. Fishery activities are finance-intensive and account for most of fishworkers’ credit. Sample fish workers have borrowed mostly (63%) for purchase / repair of boats and nets, and 14.5% for fish processing / selling. Thus fishery related activities accounted for more than three-fourths (77.5%) of their total loan. They also borrowed for non-fishery productive activities (6.5%) and other activities (16%) including consumption.

In all the districts except Puri, more than three-fourths of fishworkers’ credit went for fishery activities. In Puri district, the corresponding figure is only 51%. The share of loans for other purposes worked out at about 47% in Puri districts, but ranged between 5.2 to 13% in other districts.

Chart 5: Purpose-wise Fishworkers’Credit (Amount)

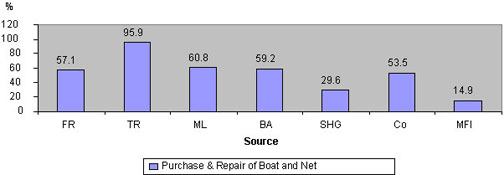

Creditors never treated fish-workers equally, while giving loans for different purposes. Traders had given loan only for fishery related activities like purchase and repair of boats/nets (96%) and fish processing and marketing (2.8%). So was the case, with other creditors, who gave proportionately more loan for fishery activities. While traders, friends and relatives and banks gave around 60% of their credit for purchase of boats and nets, moneylenders mostly supported fish processing and marketing. Friends and relatives were very unwilling to advance such loans. They, however, were found financing other activities of the fishers.

Chart 6: Fish-workers' credit for Purchase/repair of Nets/Boats

5.5: Cost of Credit

Interest rate generally represents cost of loan. Besides explicit interest rate, the borrowers are required to make implicit payments for loan. These costs may be in real form like physical labour, delay in delivery of loan etc. But no such cases were reported during the survey. On the contrary, traders claimed not to be charging interest from the fish-workers. But reality is that the borrower – fish-worker was under obligation to sell his catches to the traders at a price 5% to 10% less than the market price, which is determined daily through open auction. The cost of borrowing from traders was the estimated loss of the fishers.

Average cost of borrowing of fish-workers was about 30%, but they accessed credit at different rates across districts. While borrowers of Ganjam and Puri districts paid an average interest rate of 24%, borrowers in Jagatsinghpur and Balasore districts pay respectively 29% and 32%. The differences between average interest rates across districts could be attributed to varying interest rates charged by informal sector creditors.

Average interest rate charged by the moneylenders was high as 41.5% followed by 37.5% by traders and 29% by friends & relatives. Informal financial institutions like SHGs and Co-operatives charged lower rates of interest, but the MFI’s interest rate was as high as that of Moneylenders. Banks charged low interest rate of 11%. Moneylenders and traders were the costliest creditors in all the districts. While loan from traders is the costliest in Ganjam and Puri district, moneylenders charge the highest interest rate in Jagatsinghpur and Balasore districts.

Chart 7: Sourcewise Average Cost/Interest rate of fishworkers' credit(%)

Interest rates varied across purposes for which loans were incurred. It depended on various factors including risk involved, borrower’s urgency of requirement, impact of loan on borrower’s income etc. Loans for purchase and repair of boats/nets were costly because of high credit-risk and large size. The borrowers might migrate unnoticed without repaying the loan. Loans for other than fishing carried relatively lower interest rate as these loan were small in size and procured from informal sector financial institutions like SHG, co-operatives. Interest rate on loans for purchase / repair of boats /net was 30.5% but 18.5% for other purposes.

Chart 8: Purposewise Average Interest Rates on Fishworkers’Credit (%)

Period of loan is also an important factor influencing interest rate, while advancing loan for a longer period, the creditor parts with liquidity till maturity and is likely to demand higher compensation by way of interest. The longer is the period of loan, the higher is interest rate. When loans for less than 1 year is obtained at an interest rate of 27%, that for more than 3 years carries 32% interest rate.

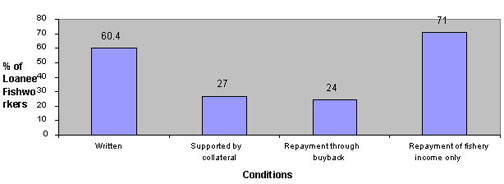

5.6: Conditions of Loan

Conditions of loan differ from person to person. The borrower’s credit standing, mutual trust, personal equation with the creditor and the practice in the region determine the conditions for loan sanction. In the sample about 40% the conditions of loans were verbal and only 27% were supported by collateral. In other words, at least 13% loans were given on trust, whereas 26% of loans were repaid through buy-back system. The scenario does not differ much across districts.

It is worrying that only 71% of sample fish workers repaid their loans out of fishery income. In other words, about 30% of fisher borrowers had to create surplus through non-fishery activities for loan repayment. On enquiry, they held high interest rate and declining catches responsible for their plight.

Chart 9: Conditions of Fishworkers’ Loan (%)

5.7: Preference for sources of credit.

There are many operators in fishery sector credit market, but still it is a suppliers’ (creditors’) market as demand for credit far exceeds its supply. A fishworker taps the source where credit is available, which may not be his preferred source.

Fishworkers look for credit with low interest rate, timely availability without much hassle and without collaterals and securities. The sample fishworkers (36%) indicated distinct preference for bank loan as it was cheap. It is worth noting that moneylenders despite their high interest rate were preferred by (23%) of sample borrowers for easy and timely accessibility. Traders were the least preferred creditors as only 12% of the respondents said so. Preference for friends & relatives, and informal financial institutions for loan was almost of the same order as that of the traders.

Chart 10: Fishworkers’ Preference for different sources of credit(%)

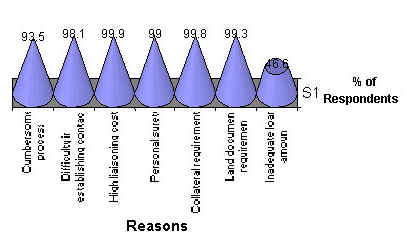

Chart 11: Reasons for Fishworkers not Availing Bank Loans (%)

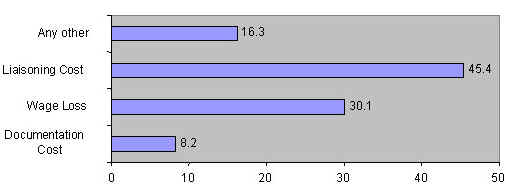

Borrowers have to put in additional efforts, both physical and monetary terms for bank loans. These costs arise on account of documentation, liaisoning, wage loss on the days of visit to the bank etc. By imputing money value to real cost and extra expenditure for the sanction as well as disbursement, transaction cost of bank loan has been calculated. On an average, transaction cost is about 10-12% of the loan amount. The borrowers hesitated to come up with the truth and there was no scope for cross checking. However, the survey data could be an approximation of the real situation. About half of the additional cost (45.4%) of the borrowers’ transaction cost goes towards establishing contact with the banks and liaisioning.

Chart 12: Shares of different components of Transaction cost for Bank Loan (%)

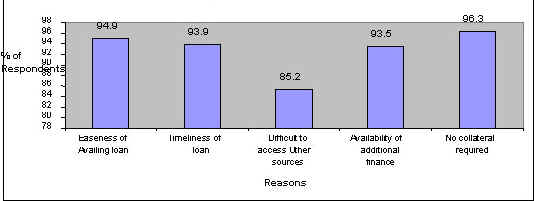

Moneylenders, traders and friends & relatives gave loan at higher cost, but they taken together accounted for half the loans of sample fish-workers. These creditors were easily accessible and gave loan in time even without collateral securities. They were not hesitant to give additional loan when required.

Chart 13 : Reasons for Availing loans from Moneylenders/Traders

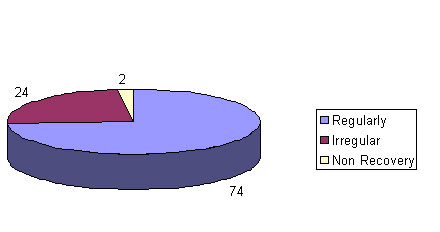

Moneylenders / traders did not seem to be unhappy with their recovery performance. They were able to recover almost all their loans to fishworkers. Only 2% of sample loans remained unrecovered due to the death of the moneylender and subsequent slackness in collection of the dues. About three-fourths (74%) of their loans were repaid regularly. The situation was similar in all the districts with differing proportions of regular repayers. Regular recovery was the maximum (86%) in Ganjam district and minimum (59%) in Jagatsinghpur district. The fishworker-borrowers in Jagatsinghpur were proportionately (40%) more irregular, followed by their counterparts in Puri district (25%), the districts with higher literate fish-workers.

Bankers informed that about 70 percent of their loans to fishers remained unrepaid or partially repaid. The bankers also were unwilling to give loan to fish-workers, usually in small amount, as it would increase their transaction cost. Therefore, sanction of loans to fishworkers has been discontinued for the last 2 years.

Chart 14: Moneylenders / Traders views on loan recovery

Borrowing is universal among the fish workers. Bankers are unwilling to advance loans to fishers due to non-recovery of earlier loans. They have virtually discontinued giving loans to fishers. Bankers now are out of reach of the fishworkers.

Informal Financial Institutions like MFIs, SHGs and Co-operatives are not popular among fishworkers because of their small-sized loans. MFIs also charge high interest rate and act ruthlessly while recovering loans. Many of the fisheries cooperatives have become defunct as share capital is not coming forth from Government appreciably.

The fishworkers borrow mostly from the traditional informal sector creditors like moneylenders, traders and friends/relatives. They are exploitative, but dependable. They give loan at the time of unforeseen exigencies like natural calamities, and damage to the boat and net etc. This loan not only helps the fishworkers to tide over the crisis, but also enables them to continue in the occupation on a sustainable basis. These creditors also advance loans to fishworkers during lean season when there is no fishing.

Fishworkers look forward to dependable, cheaper, easily accessible and timely sources of credit. A credit institution combining the virtues of both bank and non-bank institutions are the answer. Such an institution can be created with Public Private Partnership (PPP). Cooperatives of the fishworkers, bankers, government officials and NGOs at the local level can solve the financial problems of the fisheries sector. Banks would provide cheap as well as timely finance; government officials shall ensure effective implementation of government schemes and support fishworkers’ activities, NGOs will look after marketing of catches/produces.

References

-

Fisheries College and Research Institute (FCRI). (2005).“Performance Analysis of Fisherwomen SHGs in Tamil Nadu”, Thoothukkudi, Tamil Nadu.

-

Integrated Coastal Management (ICM). (2004). “A Study of the Market Supply Chains in Fisheries Sector in the Southern Districts of Orissa”, Kakinada, A.P.

-

Jayaraman, R. (2002). Performance of Self Help Groups in Fisherwomen Development in India. Paper Presented at the Coastal Zone Asia Pacific Conference, 12-16 May 2002 Bangkok, Thailand (Virginia Institute of Marine Sciences, USA).

-

Nagayya, D. (2000). Microcredit for Self Help Groups. Kurukshetra, 48(11), 10-15.

-

Narayanakumar, R and Sathiadhas, R (2006). “Domestic fish marketing opportunities for marine fisheries sector in India” , National Workshop on Post harvest Methods and Domestic Fish Marketing Opportunities, 59-67.

-

Panikkar, K K P. (1998). “Economic analysis of marine fishery of Kerala”. In: Kadalekum Kanivukal (Bounties of the Sea), Ravindran, K and Srinath, Krishna and Kunjipalu, K K and Sasikumar, V,(eds.) CIFT, Cochin, 133-137

-

Sathiadhas, R, Panikkar, K K P and Kanakkan. A (1994) “Traditional fishermen in low income trap — A case study in Thanjavur coast of Tamil Nadu”. Marine Fisheries Information Service, Technical and Extension Series, 135 , 5-10

-

UNDP, (2010), “Strengthening of Fisheries Cooperatives in Orissa”, (Draft Report).